The Wall Street Journal broke the story on the eve of July 6 that it was expected that the Trump administration would halt "risk adjustment payments" to Affordable Care Act (ACA) plans. The next day and unusually on a Saturday, CMS confirmed the story.

Journalists have since then, scrambled to grapple with the surprisingly nuanced concepts of healthcare risk adjustments. From reading some of the articles, one might think that this is a similar case to that of cutting short risk corridor payments or cost share subsidies. It is not.

Risk adjustment payments are (effectively) not made by CMS. Risk adjustment, instead, are payment transfers between ACA issuers and in no way are funded by tax payers. This is the concept of budget-neutrality. An ACA issuer that enrolls healthier individuals, and thus spends far less on their care than the premium it collects, writes a check to another issuer that enrolls sicker individuals (and spends more on their care than it collects in premium).

CMS acts as an intermediary to facilitate the transfer of money. It is by this transfer of funds between issuers that the risk is mitigated, and issuers can enroll individuals without first underwriting them and directly charging sicker individuals more for coverage (or denying coverage altogether).

These payments are an essential pillar of ACA and written in the law. Many issuers depend on this process for continued operations. Halting of the payments for any significant length of time has the opposite effect than their intent, boosting of risk rather than its mitigation.

The rationale of halting payments is soft at best (1, 2, 3), and the timeline of events is a clue.

Given the rather complicated nature of the risk adjustment program, it is not surprising to find confusion and conclusions built upon shaky premises. For example, articles have suggested how some issuers are 'losing' because they are making payments to other issuers and vice versa. One cannot infer profitability solely from the direction or magnitude of the risk adjustment transfers. In fact, some of the issuers that are making large payments to others are the most profitable. Similarly, arguments have been made that these transfers disadvantage certain types of issuers (e.g. small carriers) based on the direction of the payments. Again, the support from data is not proportional to the conviction with which these arguments are made.

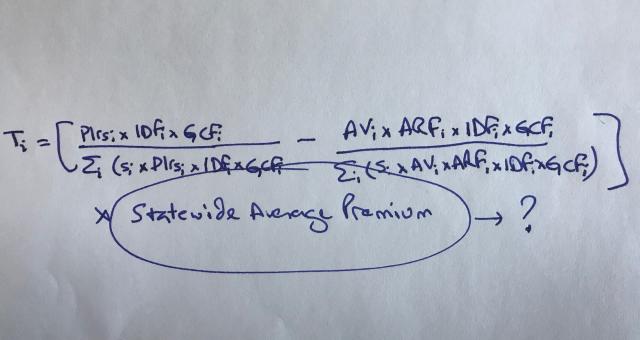

At heart of the present issue is the use of the statewide average premium in the risk adjustment transfer formula. Some have argued for the use of a carrier's own average premium instead. That change however, could make it easier for issuers to manipulate the transfers to their benefit while simultaneously ensuring that sicker individuals are under-compensated by the program. It would also result in far greater uncertainty in payments and charges, which may result in higher premiums or issuers attempting to avoid enrolling sicker individuals. The argument makes less sense as a matter of public policy than it does from the perspective of some issuers.

Risk adjustment is not perfect. There are legitimate issues and unsurprisingly, there have been material changes from 2014 to now (e.g. partial year adjustments, reduction in statewide average premium to discount admin portion in transfers, pharmacy data, etc.). However, halting of the payments introduces unnecessary uncertainty in an already anxious environment for the five-year old program.

Ironically, this comes at a time when issuers are starting to make better margins in the ACA program. Insurers expecting to make payments this year will not necessarily be cheerleaders of this development. The program is generating better margins for more issuers than it did before - and they may see this as a threat to good business.